E Invoicing Software Made Easy with 100% Compliance

Let’s understand what an e-invoice is before taking a look at EarnBill as e invoicing software in terms of its features & flexibility.

What is an E-Invoice in India?

The electronic invoice or e-invoice in India defined by the GST law in India is a digital artefact/document used to capture & report specified GST details to a Government notified portal to obtain a reference number. E-invoicing is a system where B2B invoices are authenticated electronically by the Goods and Service Tax Network for processing and exchange of information amongst the stakeholders. Considering its applicability rule, it becomes mandatory for some businesses to generate B2B e-Invoices and upload them to the Invoice Registration Portal (authorised by the Government of India).

EarnBill as e invoicing software

EarnBill’s e-invoicing solution provides an end-to-end feature that is easy to configure/integrate, generate e-invoice, and automate the process. The key features & capabilities are as follows –

- Generate an e-invoice in the system either via the billing process or manually.

- Send e-invoice automatically to users with a printed IRN number on it.

- Option to generate proforma invoice before generating e-invoice.

- Turn ON or OFF e-invoicing functionality as per business requirements.

- Option to automate e-invoice generation through scheduled task / process.

- Cancellation of an e-invoice as per the Government’s e-invoicing requirement & regulations.

- In terms of benefits of e-invoicing, businesses get 100% compliance as per e-invoicing requirements & regulations along with hassle-free operations.

More Insights

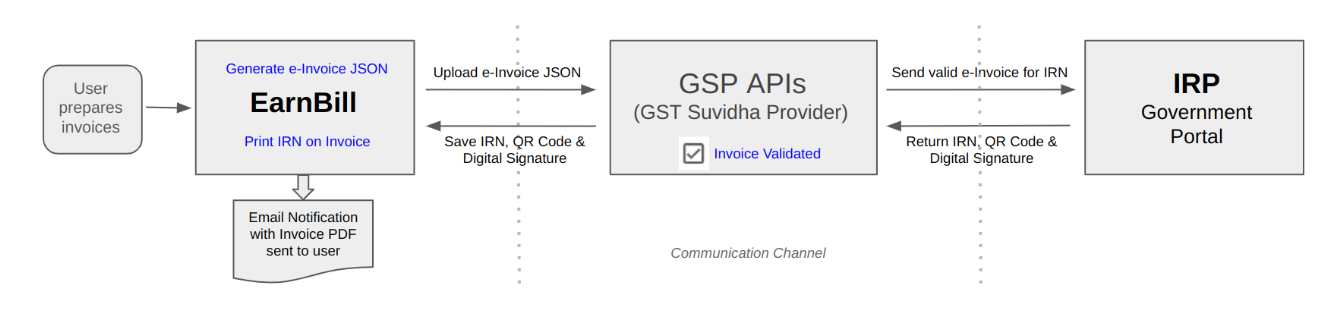

Integration Flow Diagram of EarnBill’s e-Invoicing Solution

The EarnBill’s e invoicing solution provides you with an option whether you want to generate the e-invoice during the billing process (an automated process) or the collection process (an automated process) when a payment is taken successfully. The end user will get an invoice with an IRN number printed on it.

Further, the EarnBill comes with an option to turn ON or OFF the e-Invoicing functionality depending on your requirement, especially for those businesses whose sales (turnover) are below ₹5 crore and in such situations, it can be turned off for not generating the e-Invoice.

The EarnBill offers an option to generate proforma invoices before generating e-invoices. The proforma can help you send the preliminary invoice to the customer which includes all the details of goods and/or services with the total payable amount.

You can also delete an invoice from UI as well as via API call, which internally cancels an e-invoice if there is any IRN (Invoice Registration Number) generated. The cancellation of e-invoice is only possible within 24 hours of creation and then allows you to generate a new e-invoice with corrected values.

Additional References:

You can read more about E Invoicing at Indian government Sites:

More Blogs

GST compliance software as an On-prem and subscription-based

Let’s understand how the EarnBill system can help as GST Compliance Software.

Read More…

Ad hoc Invoice - A feature that simplifies special invoice generation

“In general, ad hoc invoicing is something that has been prepared or used for some special and immediate purpose, without well planning. In other words, it is…

Read More…

What is PSD2 3DS2 (3D Secure 2.0) Compliance?

PSD2 3DS2 (3D Secure 2.0) becomes effective on 14 September, 2019, under a directive administered by the European Commission.

Read More…