EarnBill Ageing & Dunning Management

What is Ageing & Dunning Management?

Collection is the process of methodically communicating with customers to ensure the collection of accounts receivable (like unpaid invoices). In other words, it is the practice of tracking the overdue receivables on customer accounts which usually involves notifying customers, collecting money (the customers owe to the company) and/or taking appropriate action if payment is not done. It can be a time-consuming and challenging process, but it is essential for businesses to recover their money.

EarnBill’s Collections Process

EarnBill’s Collections Process is a customizable workflow (+ an automated process) comprising various configurable aging steps along with actions through which business owners can send initial reminders, collect payments, send warning notifications, and/or suspend customer accounts (stop services) too if overdue invoices are still unpaid.

In the collections, the name of the step actually represents the customer status/state for a particular step and helps to keep track of customer accounts. For example, after generating invoices suppose a customer still has an overdue invoice(s) which remains unpaid. In this case, the EarnBill collections process will pick the customer and move the status of the customer’s account to indicate their position in the workflow. Another use case could be, just sending gentle reminders to customers helps collect payment and improve your business’s cash flow.

A typical workflow actions include – send notification, make payment, suspend the customer’s account etc. A customer who is suspended can still make payments to renew the subscription / services and as result their account status will become active.

How Does It Work?

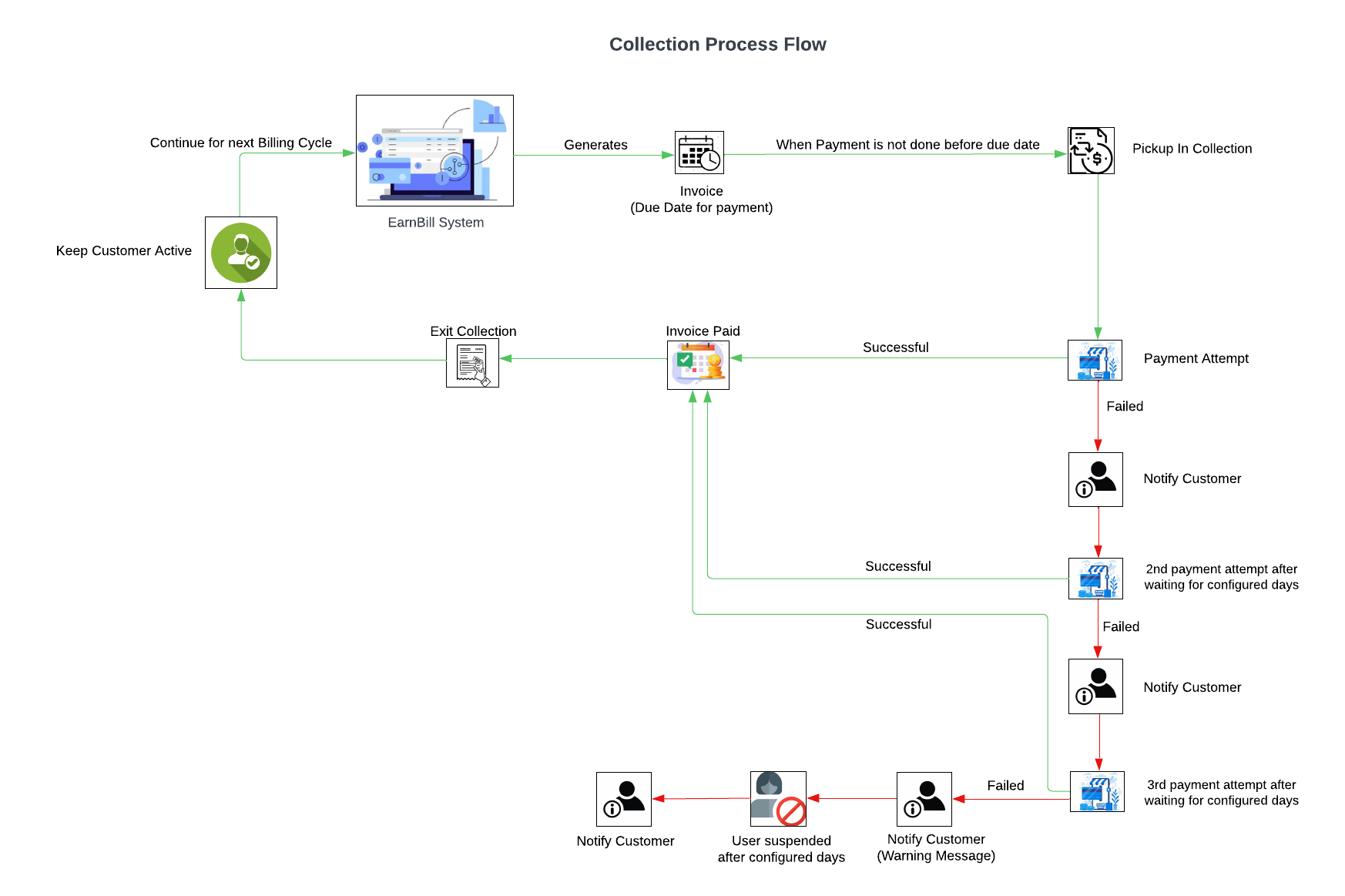

Let’s understand it through a simple use case as depicted in the flow diagram below considering when a company has the following set of rules.

1: Collect Payment automatically on the due date.

2: Notify the customer if payment fails.

3: Wait five days, and make two more payment attempts.

4: If there is no payment after, suspend the account and notify the customer.

Key Features

EarnBill’s Collections capability is designed to simplify and automate the complex process of handling notifications & revenue realization. Let’s take a look at the capabilities / features below.

Collections Workflow Types

EarnBill offers two separate workflows with its own purpose, one is for Active accounts and another is for Canceled accounts as explained below.

Collections For Active Account:

This is the standard workflow designed for active customers who have an overdue invoice(s) which remains unpaid. The collection workflow will pick up such customers – let’s take a simple use case of an active customer whose invoice is generated with a due date to make payment, however if the customer has not paid the invoice on time then the collection process will pick that customer up to attempt payment automatically, and will notify the customer. If payment fails the system will wait for configured days (per business requirement) before reattempting the payment and if payment fails again then the system will send a warning notification and will wait for configured days before suspending account. If payment is done successfully at any stage of the collection, then the customer will exit collections and will remain active for the next billing cycle otherwise will continue aging to suspend the customer account. The process does not end here, in fact the system allows the customer to make payment even if suspended and ensures that the account is active after payment, and if it happens then the customer will leave the collections process.

Collection For Canceled Account:

In EarnBill, it is possible to configure separate collections steps for invoices from canceled accounts as the collection handling is a bit different than standard workflow. The canceled invoices are generated by the EarnBill system for those customers who have canceled their services / subscriptions using the EarnBill’s cancellation request feature. For example, a customer has canceled the subscription despite all efforts to retain, in that case the canceled invoice will have all applicable charges for that month along with any other outstanding. Suppose, the customer has not paid the invoice before the due date, then this collections workflow will pick that customer up for sending notification followed by payment attempt automatically.

Easy Configuration

EarnBill offers you to define as many steps (state) as you want per your business requirement. You can create the name of the step, configure the number of days (wait period) and action to be triggered. The action will be triggered after waiting for the number of days defined since the due date of invoice. Everything is easily configurable and anytime you can add/remove steps, update the number of days, and/or turn off the actions. This flexibility helps businesses to apply the changes in the system efficiently as and when the business rules / policies changes take place.

Actions In Collections Process

Notification:

This option (if enabled) in the collections process sends a notification when the customer reaches a notification step. This feature is available in both workflows.

Payment:

This option (if enabled) triggers a payment attempt automatically. If the payment is successful, the customer leaves collections however if the payment is not successful, the customer continues in collections. This feature is available in both workflows. Automatic payments can also be arranged / scheduled before the collections process.

Suspend:

This option (if enabled) triggers suspension of the customer if the invoice is still unpaid. Such customers will no longer have any invoices generated until they are Suspended. This action is applicable only for Active account workflow.

Stop Activation on Payment:

This option (if enabled) keeps the account status remains Suspended and does not activate automatically even if full payment is made. This may be useful when an account has gone to a collections agency (typically in the Telecom sector), and it should not automatically be re-activated. This is applicable only for Active account workflow.

Exclude From Collections

EarnBill also offers a feature to exclude a customer from the collections process if needed. What this means is, let’s consider a use case where suppose you don’t want to include a customer in the collections process due to any reason then you can use this flag at the customer level. If this field is enabled, then the customer will not be notified, no automatic payment attempt even if the customer has any past due invoices.

Manual & Automated Options

EarnBill offers manual as well as automated options to trigger the collections process. The EarnBill UI interface allows you to run the collections process by just clicking a button, alternatively one can configure a plugin (a scheduled job) to automate this process at a predefined frequency.

Integration and Scalability

EarnBill provides you some collection process APIs which can be used to integrate with your existing systems / application. Additionally, with a plugin based design EarnBill also offers easy customization as per your business requirement. Further, scalable architecture ensures that it can handle high transaction volumes as your business grows.

Collections Reports

EarnBill provides various reports like Accounts Receivable, Collections Balance Detail, Ageing Balance Details and few others. These reports can help businesses gain better insights into their accounts receivable data. This information can further be used to identify areas of improvement, correction if any and making better business decisions.

Key Benefits

Collection process is essential for businesses of all sizes as it affects the revenue collection, customer experience and organization’s growth. Considering this, EarnBill offers a flexible & features rich collection process which can help businesses in many ways like improve customer relationship & retention, maximize the revenue realization / collections flow, achieve better work efficiency and the overall experience.