Prepaid Billing

As a service provider, it is important that you understand why prepaid billing is more popular. When your customers are price conscious, then prepaid billing is the best option for you. This is because it enables users to track their usage and adjust their spending accordingly. Furthermore, it decreases the amount of human work required to track bills and payments.

What is Prepaid Billing?

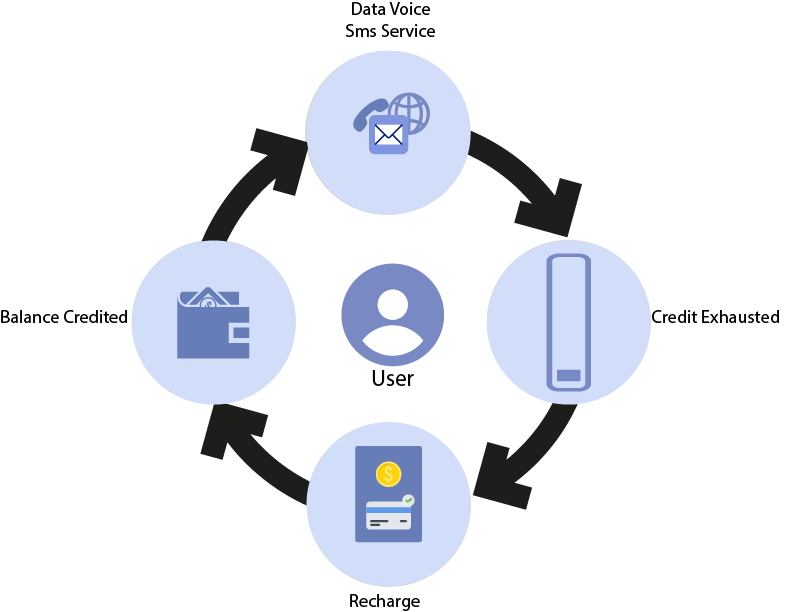

Prepaid billing serves as an important payment mechanism for companies. It enables customers to buy credits in advance from company or service providers. Companies can allow their customers to monitor their account balance after using each service. If the account balance is exhausted, customers are free to purchase credit and top up their accounts if they want.

This eliminates complicated service agreements and credit checks and simplifies expenditure management. EarnBill’s Prepaid Billing feature is very useful for companies because it has all the features that you need as a service provider. You can allow customers to see or get alerts for their balances after using each service or at 50%, 75%, or 100%, which means exhausted quota. In addition, customers can top up their accounts by various methods.

Typical Issues With Traditional Billing Systems

In traditional billing systems, characterized by their postpaid nature, there is often confusion due to their inherent complexity and lack of transparency. It is commonly assumed that unexpected charges, billing errors, unfair contract terms, billing discrepancies, and a lack of cost control result in a mismatch between customer expectations and the actual service received, which results in customers’ dissatisfaction.

There is no doubt that it delivers an effective answer to these fundamental concerns by addressing them directly. Prepaid billing allows clients to pay for services in advance. Customers have complete control over their spending, so there is no chance of a bill shock. It works on a simple principle, the customer pays in advance for services. These services can be used until the balance is exhausted or the validity period expires. Because of this mechanism, clients are always aware of their available account balance and can control their usage accordingly.

Lets understand with an example

As an example, let us take the case of Ava, who pays a company for her postpaid plan and who pays a monthly fee for the service on a monthly basis. The plan includes unlimited calls and messages, as well as a set quantity of data each month for a fixed price. Ava’s final bill at the end of the month includes additional charges for a variety of services that weren’t specifically mentioned in the initial contract, such as international calls, premium SMS, and data overages. Consequently, Ava experiences unexpectedly high costs as a result of the complex fee structure and, therefore, feels cheated since the complex fee structure was not clearly stated when Ava subscribed to the service.

Meanwhile, let’s look at another customer, Henry, who chooses a prepaid mobile plan. Before starting the service, Henry needs to pay a plan amount, which is credited to his account in advance. That preloaded balance covers a certain number of calls, texts, and data for a set period of time. Henry can track his balance at any time using the mobile app, which updates in real time as he uses the service and as his balance changes. When his account has zero balance, the service stops unless he chooses to recharge it. Using prepaid billing, Henry has never faced surprise bills because his consumption is automatically limited to the amount of money that was initially paid by him.

Henry would be happier with the service because he has complete authority over his spending and does not have to worry about a “bill shock.”

Prepaid Billing Improves Operational Efficiency and Customer Relationships

Prepaid billing solutions enable companies to manage their customers more efficiently as well as generate revenue for the business. Customers make upfront payments. Because of that they stabilize your cash flow and lower the administrative costs involved with invoicing and collection issues.

The transparency and fairness between businesses and their customers result in various benefits, such as improved loyalty in the relationship between companies and their clientele.

👉 How Does Prepaid Billing Work in EarnBill?

👉 Future predictions for Prepaid Billing.

👉 What is the difference between prepaid and postpaid billing?